- #FREE CASH FLOW CALCULATOR HOW TO#

- #FREE CASH FLOW CALCULATOR SERIES#

- #FREE CASH FLOW CALCULATOR FREE#

Net Working Capital = Current Assets – Current Liabilities NOC = Net Working Capital + Property,Plant,and Equipment (PP&E) NOC bis the periods beginning Net Operating Capital, and NOCa is the periods ending Net Operating Capital, and Step 1: Calculate the period’s Change in Operating Capital (NOC) using the Balance Sheet. Calculating FCF using sales revenue is a good option that allows you to reveal FCF by starting with total sales and reducing it by taxes, operating expenses, and the period’s change in operating capital.įollowing this methodology is easiest when broken into two separate steps. In these cases, you can still calculate FCF so long as both the Balance Sheet and Income Statement are available. In certain cases the cash flow statement might not be available or useful for calculating FCF. The formula for calculating FCF using operating cash flow is:įCF=Cash Flow From Operations – Capital Expenditures Calculating FCF Using Sales Revenue The two items needed to perform the calculation using this methodology are 1) Operating cash flow, located on the Cash Flows Statement, and 2) Capital Expenditures, which are located on the balance sheet. This is the most commonly applied method of calculating FCF because it is both simple and the information is almost always available in the financial statements. Calculating FCF Using Operating Cash Flow

The three approaches help provide a way to calculate FCF regardless of the type of financial statements being analyzed. This is because financial statements are not always uniform, or standardized, across different industries and companies.

#FREE CASH FLOW CALCULATOR FREE#

There are three different approaches you can take when calculating free cash flow. In the same vein, it makes it important for industry professionals as they look to more efficiently manage financial operations and overhead. This makes it an important metric used by investors to understand how financially stable a business is and how effectively it is managing its capital structure to generate profit. As the name implies, when cash is “free” that means that it is available to fund future growth initiatives, cover debt financing, or pay dividends to shareholders. The name free cash flow derives from the fact that the calculation reveals how much cash is remaining, or “free”, after a business pays for all of its operating and capital expenses. This means that FCF is a reflection of the true cash-creating potential of a business. What Is Free Cash Flow?įree cash flow, often referred to as “FCF”, is a formula for calculating the excess cash a business generates through its normal course of operations.

#FREE CASH FLOW CALCULATOR HOW TO#

In this post we will cover what free cash flow is, the various ways to calculate it and how to interpret the results. This is because it is a practical form of analysis that can be helpful for many stakeholders. Like many financial metrics, free cash flow is used by both investors and industry professionals alike.

#FREE CASH FLOW CALCULATOR SERIES#

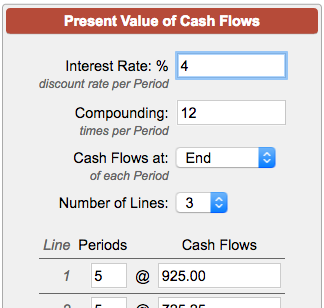

PV, of a series of cash flows is the present value, at time 0, of the sum of the present values of all cash flows, CF.Free cash flow is one of the most widely used tools analysts use to assess a business’s financial health. Payments at Period Beginning or End Choose if payments are made at the beginning of each period (like an annuity due in advance) or at the end of each period (like an ordinary annuity in arrears) Cash Flows The cash flow (payment or receipt) made for a given period or set of periods. You might have a yearly rate and compounding is 12 times per yearly period, monthly. Compounding is the number of times compounding will occur during a period. Rate per period This is your discount rate or your expected rate of return on the cash flows for the length of one period. Just be sure you are consistent with weeks, months, years, etc for all of your inputs. Commonly a period is a year or month. However, a period can be any repeating time unit that payments are made. Periods This is the frequency of the corresponding cash flow. To include an initial investment at time = 0 use Present value of uneven cash flows (or even cash flows). Calculate the present value ( PV) of a series of future cash flows.

0 kommentar(er)

0 kommentar(er)